Lodging a tax settlement for the previous fiscal year might seem bit challenging, especially when you are aware that you are not getting a return, instead paying for it, but being prepared can make lodging your tax return a lot easier. Regardless of the amount of return or payment, you must lodge a tax settlement if you are staying in Australia as a taxpayer.

Deductions

If you’re earning income, you may be able to claim some expenses related to your work and income in your tax return. You can check the ATO website for more information on tax-deductible expenses you can claim.

How to lodge your tax return

If you are an international resident in Australia, some of the information you’ll need to prepare your tax return is your:

- Tax File Number (TFN),

- Your BSB and account number,

- Child’s support payments details, (only if you were eligible in certain visa subclasses)

- Income Statement, (accessible from your ATO online services via myGov, or a payment summary provided by all your employers).

- Summary of any interest earned from bank accounts,

- Summary of investment income, such as shares, dividends, and managed funds,

- Summary of benefit received from Centrelink,

- Summary of benefit received from your superannuation company,

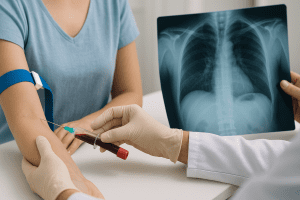

- Medicare and Private health insurance statement,

- Receipts for charity donations if you have made any in last fiscal year,

- Receipts for work-related expenses,

Can I lodge my own tax return?

Yes, you can lodge your tax return directly with the ATO by yourself subjecting upon the access of required login information and ATO’s availability.

Or you can also get a registered tax agent to help you with your tax return. It can be helpful to get a tax agent to help with your tax return. They’ll charge you certain amount of fee which may be variable from one to another, but the amount you pay to lodge your tax return can be tax-deductible when you lodge the following year.

If you lodge your own tax return, you will need a myGov account first. The ATO website may state the processing time and we encourage you to check it if you are looking to find the duration. Electronic returns are normally processed within 2 weeks, but paper returns are processed manually, taking up to 10 weeks and this may change from time to time.

What happens once I lodge my tax return?

Once you complete you tax lodgement, you are generally provided with a Notice of Assessment (NoA). This let you know whether there is any due refund or payment (from/to) ATO. It’s very important to hold onto your NoA and the information you used to prepare your tax return. You may need this information in the future. We recommend you save it printed or on your email securely.

Have you found a mistake on the lodgement?

If you have found a mistake after the lodgement is completed, you’ll need to lodge an ‘amendment’ of your tax return. You can check the ATO’s website for information on amending your tax return. Your accountant, tax agent or financial advisor may also be able to help you with the process.

Things you should know

- The Australian income year ends on 30 June. You are generally provided a time from 1 July of to 31 October of similar fiscal year to lodge your tax return for the previous income year. If you use a registered tax agent to prepare and lodge your tax return, you may be able to lodge later than 31 October.

- Tax law is subject to change. For the latest information, check ATO’s website or with your accountant or financial advisor.

- The information provided is of a general nature and doesn’t consider your personal financial situation – we suggest you seek independent taxation and financial advice. This page is intended to provide general information only and does not consider your individual objectives, financial situation or needs. Taxation considerations are general and are purely based on current taxation laws and may be subject to change. The information provided on this page may not be valid and to ensure its’ validity, please come in touch with us or any Registered Tax Agent of Australia.

- Visa Help Services is also not a registered tax (financial) adviser under the Tax Agent Services Act 2009 however we do partner with experienced Registered Tax Agent and provide seamless services in this process. You may seek tax advice from other registered tax agent or a registered tax (financial) adviser if you intend to rely on the information to satisfy the liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law.

Latest News & Blogs

Tax Deductions

How to lodge an individual tax return

Student Visa – Subclass 500